Courtesy of Lewis Walpole Library

We all complain about the taxes we pay, back in the 18th century things were no different, but perhaps government offered a little more clarity about exactly what you were paying for. If it could be taxed the Georgians found a way to tax it!

In this blog I’m going to take a quick peek at a few of these. Most of us are familiar with the existence of land tax and hearth tax, but some of these are somewhat more obscure. Mocking the government was a splendid ‘sport’ for caricaturists and let’s face with some of these taxes they were spoilt for choice! So, here we go –

The Brick Tax

Courtesy of Lewis Walpole Library

This was introduced in 1784 as a means of helping to pay for the wars being fought in the American Colonies. Tax was paid at the rates of 4 shilling per thousand bricks. Clearly this was not going to be popular so the way to reduce this levy was simple – make bigger bricks, so that you wold use less. That went well (not)! The government simply changed its rules and stipulated a maximum size for a brick. As you can imagine some of the smaller companies simply went out of business. The other option was that more timber was used as an alternative. The tax was finally abolished in 1850 as it was regarded as a detrimental tax to industrial development.

Candle or Beeswax Tax

From 1709 the government created yet another tax, this one went further than simply a tax. The making of candles in the home was also forbidden unless you held a licence. As a result an alternative form of lighting known as rush lighting was used as this was exempt. Rushes were dipped in animal fat then left to harden; these could then be lit at both ends, they only provided light for a very brief period of time though, but they were tax free! That could also be where the saying ‘to burn the candle at both ends’ originated.

Clock and Watch Tax

In an attempt to generate revenue for the country, in 1797 William Pitt imposed yet another tax – the clock tax. This tax required a payment of five shillings on every clock, even within a private home, two shillings and sixpence on pocket-watches of silver or other metal, and ten shillings on those of gold. As you can imagine this proved immensely unpopular and was scrapped after only nine months. So that went well!

Gin Tax

How many of us like the occasional gin & tonic, ice and a slice? Well, in 18th century London the massive increase in the rate of consumption gin aka ‘mother’s ruin’ became a cause for concern, leading to more increased rates of crime and laziness, so the government of the day simply increased the tax on it. As you can imagine, yet another tax that went down well, this increase in tax caused riots in London in 1743. The tax, although not abolished was significantly reduced over the next few years.

Glass Tax

In 1745 the Glass Excise Act came into effect. Glass has always been sold by weight and glasses traditionally had thick stems therefore weighed more than fragile thin stems. With this introduction of this tax, the solution was yet again quite simply – glass manufacturers simply switched to making glasses with hollow stems making them cheaper! However, in Ireland glass could be made without taxation meaning that Ireland was better placed to manufacture high quality, thick stemmed glasses as a reasonable price.

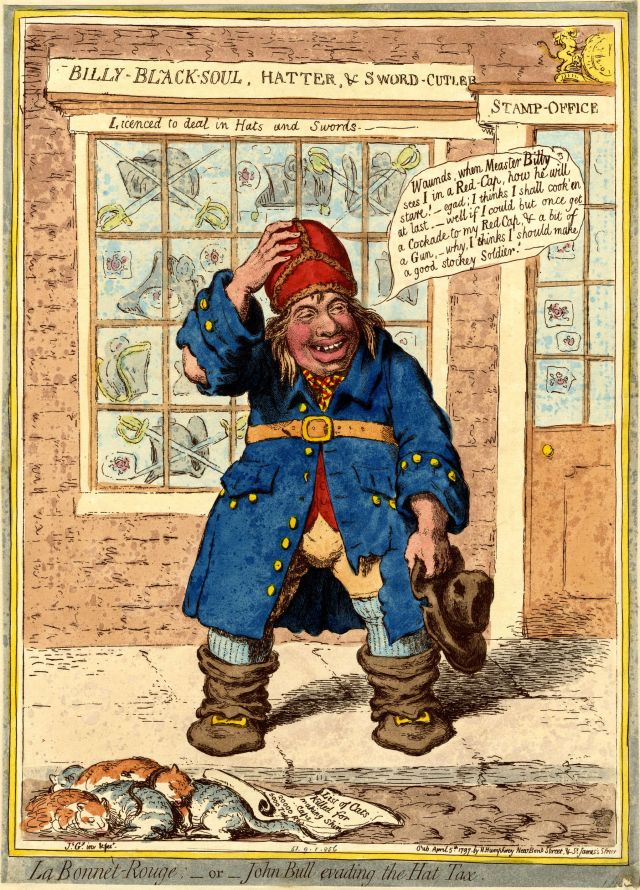

Hat Tax

This tax was easy, the wealthier you were the more hats you were likely to own and the more expensive they were likely to be, so if you were poor you were unlikely to be able to afford a hat at all, therefore nothing to pay. The hat was required to have a revenue stamp stuck inside on its lining. Hefty fines were issued to milliners or hat wears who failed to pay the tax. The death penalty was available for anyone who made the mistake of forging a revenue stamp, so be warned!

Medicine Tax

In 1783 a tax was imposed on medicines that were sold by anyone who was not a surgeon, druggist or apothecary. In 1812 this was replaced with the Medicines Stamp Act which meant that the stamp duty paid had to be attached to the packaging if it was not deemed to be of a certain standard or made using a well-known recipe. If the medicine cost one shilling the tax was one and a half pence, it was charged proportionately.

Playing Card Tax

This was certainly one we had never come across, and even more amazing is the fact that the act was still in place until 1960. Playing cards was seen as addictive gambling and as such proved to be an easy source of income generation. In order to prevent tax avoidance the Ace of Spades was held by customs and only issued once duty had been paid by the card maker. (More information about the history of playing cards can be found on the website of The Worshipful Company of Makers of Playing Cards.

Soap Tax

![Lord N[ort]h, in the suds. Satire on the soap tax.](https://georgianera.files.wordpress.com/2015/03/lwlpr04927-soap-tax.jpg?w=640&h=479)

Soap makers were charged a very high levy on the soap they manufacture, so much so that many of them left the country and moved abroad to avoid the tax. The way in which the law was worded effectively meant that soap production has to be in batched of no less than one ton. It was even reported that the pans used to make the soap had to be locked at night by the tax collector to ensure that no illegal production to take place ‘after hours’. Soap was, therefore regarded as a luxury item and therefore wasn’t in common use until the mid-1800’s.

Wallpaper Tax

This tax was introduced into Great Britain in 1712 as using wallpaper was provided a cheap alternative option to tapestry or panelling. The government saw this as another of generating much needed income, so with that the taxed people for buying patterned, painted or printed wallpaper. The tax was originally levied at 1 pence per square yard, this was increased to a shilling by 1809. The solution to paying this tax was easy – use plain paper and have it hand stencilled therefore no tax to pay. A totally legal form of tax evasion. Needless to say this tax didn’t work and was abolished in 1836.

Window Tax

This tax pre-dates the Georgian period but continued throughout and after the Georgian period. It was comprised of two parts.

There was a flat rate of two shillings per house then, and this where those with larger houses with more windows were penalized, a variable rate was charged for the number of windows above ten in the house. Tax due if you had over 20 windows was a colossal eight shillings! There were of course some exemptions such as people in receipt of parish relief. The tax was amended several times and often regarded as unfair and seen by some as a tax of light and air. The tax was finally repealed in 1851.

Other taxes included newspaper tax, glove tax, perfume tax and hired horse duty. Those who were wealthy enough to own luxury items such as coaches, silver plate or male servants also had to pay specific taxes on these items too.

For our blog on hair powder tax, click here.